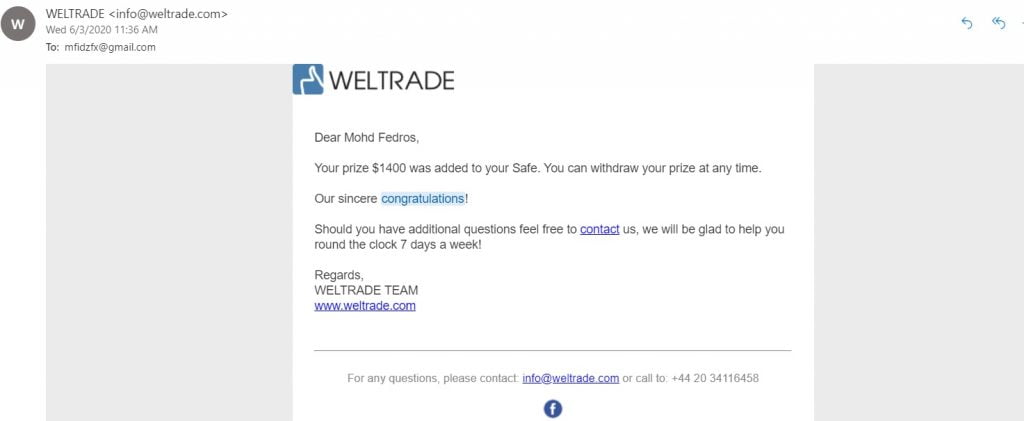

Tahniah kepada Pemenang Iphone 11 Max Pro. Trade Profit dapat pulak hadiah Iphone.

Pemenang Iphone 11 Max Pro boleh memilih samaada untuk mendapatkan Iphone ataupun cash sebanyak USD 1400.00 Kredit kedalam akaun trading

kami amat menggalakkan kepada trader Profesional, Fund Manager untuk berdagang di weltrade kerana anda mungkin salah seorang yang akan memiliki Iphone 11 Max Pro ini.

14. Free iPhone 11 Pro Max promotion conditions

14.1. To get the prize the Client needs to have total deposit of $5 000 and complete a trading volume of 250 lots from the start of the promotion. 1 lot on Micro account equals 0.01 standard lot. Trading volume for XTIUSD and XBRUSD instruments is accounted with the coefficient 0.1.

14.2. The total deposit is calculated by the formula: deposit amount minus withdrawal amount.

14.3. Offsetting locking positions are not taken into account when calculating trading volume. If the Client opens an offsetting locking position with the volume not equal to the position opened previously, the system will take into account only the volume not covered by the lock.

14.4. Orders on Micro, Premium, Pro and ZuluTrade accounts with the duration less than 2 minutes are not taken into account when calculating the trading volume.

14.5. A closed order is not calculated for the promotion turnover if the difference between the opening and closing prices is less than the MTP value of the corresponding instrument.

14.6. When the promotion requirements are fulfilled, the client should send a request for a gift to info@weltrade.com or contact customer support via LiveChat.

14.7. The Client can choose either 64GB iPhone 11 Pro Max or $1 400 cash compensation available for withdrawal without any limits.

14.8. If any trade manipulations or violations of trade conditions are detected, the Company has the right to refuse the Client to participate in the promotion at its own discretion.

14.9. The company reserves the right to change the terms of this promotion unilaterally or to suspend it completely at any time.

14.10. The company has the right to replace the prize with the cash compensation.

14.11. The promotion starts 07.11.2019 and ends 07.11.2020.

14.12. The Client can get only one prize during the promotion.

buka akaun sekarang https://my.weltrade.com/trading/type_account?r1=ipartner&r2=10504

Ketua Strategi Pasaran Global AxiCorp Stephen Innes, berkata mata wang tempatan dipengaruhi pergerakan dalam pasaran minyak mentah dunia.

Ketua Strategi Pasaran Global AxiCorp Stephen Innes, berkata mata wang tempatan dipengaruhi pergerakan dalam pasaran minyak mentah dunia.